Each and every U.S. school has its very own necessities for a way international students can verify their capability to pay out expenses.

The Dr. Emma Lerew Scholarship supports underrepresented and underprivileged Fantastic students centered on careers in education. This scholarship aims to empower the following generation of educators committed to creating a difference within their communities and outside of.

Find Economic Aid Information: If you need extra clarification concerning the greatest loan option for your circumstances, think about consulting with your university’s monetary support Workplace.

The federal direct grad PLUS loan makes it possible for suitable students to borrow approximately the cost of their instruction, minus another financial help received.

Note that consolidation could lead on to an extended repayment time period, increased interest, loss of particular borrower Advantages And maybe better financial debt Eventually.

Look at Interest Expenses: Fully grasp the implications of interest accrual. Subsidized loans offer a big edge with their interest-absolutely free standing As you’re in class, over the grace period of time, and during deferment.

You will find your interest rate aspect by dividing your loan’s interest fee by the quantity of days in the calendar year.

Trim your spending budget: Create a detailed price range outlining your month-to-month behaviors. Do you really want that extravagant latte? Even though It appears reasonably priced, remember that each individual tiny little bit will help.

If the application is authorised, the lender will share forms to accomplish, and can Call your faculty to certify the loan total.

For the reason that federal student loans have such wide-ranging repayment adaptability, it’s advisable to max out your federal loan allotment in advance of resorting into a private student loan.

As soon as you’ve attained approval, your lender will certify the funding sum together with your higher education or university. You may well be permitted to borrow up to one hundred% of the price of attendance minus other monetary assist you be expecting to receive.

A Graduate PLUS Loan performs by delivering economic aid to graduate or Skilled students enrolled no less than half-time within a qualifying diploma method.

Mounted interest costs: here Federal loans have fastened interest premiums, indicating the interest amount won't ever change. Interest prices on private loan are often variable, which suggests your interest prices and payments could go up after a while.

Assistantships and Fellowships: Graduate assistantships offer a stipend and tuition waiver in exchange for get the job done for the university. Fellowships offer you economic support depending on academic achievement or research likely.

Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Brandy Then & Now!

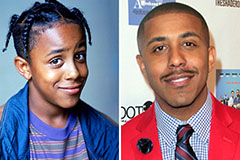

Brandy Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!